CHAPTER 1:

Implementing action

The Charter calls on signatories to measure, publicly report and independently verify greenhouse gas (GHG) emissions and their performance and progress in reducing emissions.

Measuring impact, tracking progress and reporting on performance are critical for building trust, ensuring accountability and achieving meaningful outcomes. Since its launch in December 2023, OGDC has adopted a phased, multi-year approach to systematically track signatories’ progress and support the continuous improvement of data quality over time.

In 2025, OGDC started improving the reporting process by leveraging the Oil and Gas Climate Initiative (OGCI) Reporting Framework as the basis for data collection – developed in line with international best practices – to improve consistency and enable data comparability over time.

50 of 55 signatories submitted data, covering 98% of OGDC’s total operated oil and gas production. Notably, three signatories participated in the survey for the first time, 35 provided previously unpublished data on GHG performance, and two established their inaugural emissions baseline. The progress reflected in this report is a direct result of collective action and collaboration.

Spotlight on

Establishing a Baseline

In 2024, 48 of 54 signatories submitted data that captured each individual company’s starting point prior to joining the Charter. That survey marked the industry’s first ever survey of climate efforts at scale. It also highlighted opportunities to further drive down emissions, improve data quality and consistency by developing shared reporting definitions and better define targeted support to the signatories.

Tracking progress by collecting data from a broad and diverse group of companies presents complexities. Progress made by individual signatories takes various forms. Some signatories have established a baseline for the first time, others have enhanced data quality and some have even adopted third-party verification for the first time. Ultimately, the shared goal remains the same: achieving meaningful emissions reduction.

Equinor values the opportunity to share input to OGDC’s 2025 Status Report survey. By asking the right questions, we can help drive greater transparency and accountability across the sector, making a difference. I look forward to working alongside peers on this important topic.”

Anders Opedal, CEO, Equinor

Assessing GHG reporting, Ambition Setting and Action Plans

OGDC worked with DNV, an independent third-party verifier, to collect data, verify consistency with the Charter, issue a verification statement on the actions taken by the signatories, and identify opportunities to improve data quality. DNV’s verification statement can be found in the Appendix of the report.

DNV

DNV Methodology

DNV conducted the verification in accordance with its internal quality system and established procedures, applying a structured scoring methodology to ensure objective and consistent assessments across all signatories. Survey responses were evaluated against four key criteria: completeness, self-reported consistency with the official OGDC text, public availability and traceability. Questions deemed not applicable to a specific signatory (e.g. those related to operational control for equity-only participants) were excluded from that signatory’s score to ensure fair comparability.

- Completeness assessed the proportion of applicable questions answered by each signatory.

- Self-reported consistency evaluated whether a signatory declared alignment with the question asked and the Charter’s ambitions, limited to the questions within DNV’s defined scope (a detailed explanation of the verification process is provided in the Appendix).

- Public availability and traceability examined whether answers given to the different questions could be verified through public or non-public documentation supplied by the signatory.

A full score was awarded when all responses within DNV’s scope were fully consistent with the OGDC official text, all relevant sub-questions aligned with the Charter’s ambitions, and the claims were supported by publicly available and traceable evidence. Partial consistency was assigned where only some sub-questions met these conditions or where public/internal evidence was incomplete. A zero score was recorded where the response indicated non-alignment with the Charter ambition or where no supporting documentation was provided.

DNV provided a full verification statement for process improvement and a partial verification statement for overall emissions – covering process assurance but excluding aggregation of emissions. Please refer to the Appendix.

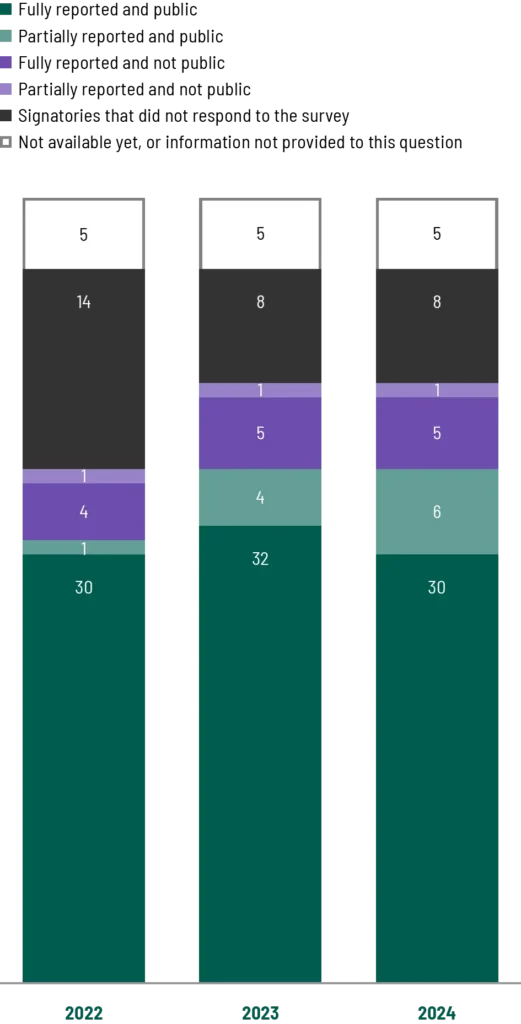

GHG emissions reporting and assurance statements

44 signatories submitted at least one year of data on their Scope 1 and 2 emissions.1 Although the overall number of reporting signatories has increased over time, the 2024 figure does not yet account for several signatories still in the process of compiling their data. These additional submissions are expected to be reflected in next year’s report.

Figure 1: Number of companies with Scope 1 and 2 emissions reporting

Assessment by OGDC (Source: OGDC analysis of the 2025 Charter Survey).

The 2024 coverage period extends through June 2025.

1 For definitions on Scope 1 and 2 emissions, please refer to the “Data Aggregation, Methodology and Reporting” section below.

DNV assessed whether OGDC signatories have established independent third-party verification systems for GHG emissions reporting. The total number of signatories with third-party verification improved over time. The quality, public availability and traceability of these verification statements have improved year on year.

For the first time, OGDC signatories were asked if they update their GHG emissions indicators on a yearly basis. DNV verified that 78% of signatories undergo such reviews and updates.

Figure 2: Number of companies that annually update GHG indicators

Assessment by the independent third-party verifier (Source: DNV analysis of the 2025 Charter Survey, labels simplified for readability by OGDC and categories merged for simplicity).

The 2024 coverage period extends through June 2025.

Figure 3: Number of companies with third-party assurance statements for GHG emissions data

Assessment by the independent third-party verifier (Source: DNV analysis of the 2025 Charter Survey, labels simplified for readability by OGDC and the categories merged for simplicity).

The 2024 coverage period extends through June 2025.

Interim Decarbonization Ambitions by 2030

The Charter calls for all signatories to reach net-zero operations by or before 2050 and encourages them to “set and share publicly the aspiration for 2030 of Scope 1 and 2 carbon dioxide equivalent (CO2e) emissions (absolute and/or intensity).”

42 signatories, covering 94% of OGDC’s oil and gas production, now have such ambitions in place, up from 36 signatories last year. In 2024 most signatories made their interim ambitions publicly available or traceable. Improvements were, in part, attributed to the efforts and engagement of signatories through the signatory-led Collaborate & Share program.

DNV independently verified progress on interim ambitions, noting increased transparency and consistency in signatories’ reporting on ambitions.

Figure 4: Number of companies with company-specific interim scope 1 and 2 emissions reduction ambitions

Assessment by the independent third-party verifier and OGDC (Source: DNV analysis of the 2025 Charter Survey, labels simplified for readability by OGDC and the categories merged for simplicity, and OGDC analysis of the 2025 Charter Survey).

The 2024 coverage period extends through June 2025.

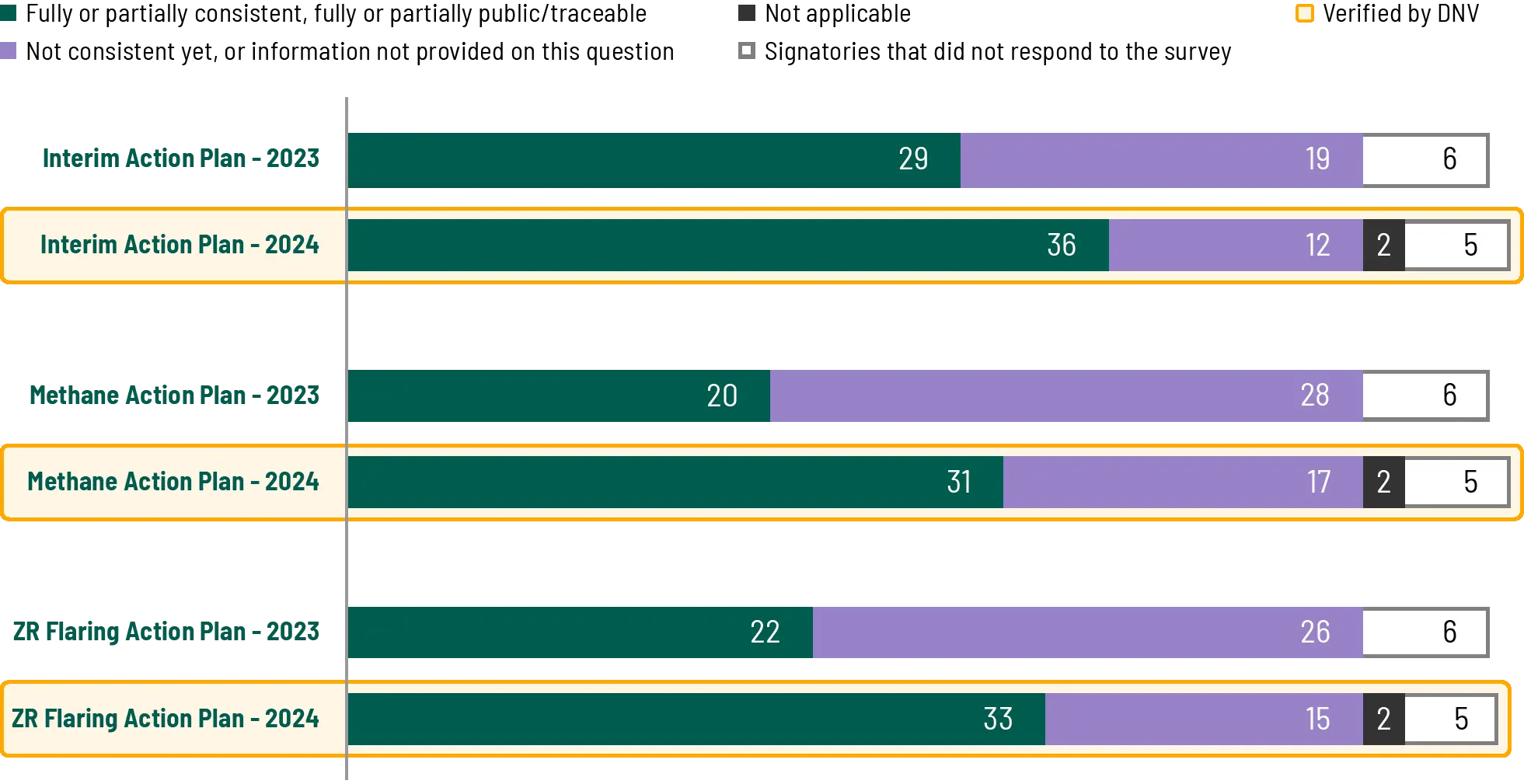

Action Plans for 2030

Signatories were asked to articulate their voluntary 2030 mitigation action plans in accordance with the Charter’s aims.

By end of 2024, more than half of the companies, covering more than 80% of OGDC’s oil and gas production, had voluntary action plans on Scope 1 and 2 emissions, near-zero methane emissions and routine flaring. While these action plans display varying levels of transparency and consistency with the Charter, in general, they show improvement over the previous year.

Of the 42 signatories (representing 94% of OGDC operated production) that set voluntary interim Scope 1 and 2 emissions reduction ambitions, 36 (91% of OGDC operated production) provided action plans. On near-zero methane and routine flaring, respectively, 31 signatories (86% of OGDC operated production) and 33 signatories (81% of OGDC operated production) reported action plans in 2024.

Figure 5: Number of companies with Company-specific SCOPE 1 AND 2 VOLUNTARY MITIGATION ACTION PLANS

Assessment by the independent third-party verifier and OGDC (Source: DNV analysis of the 2025 Charter Survey, labels simplified for readability by OGDC and the categories merged for simplicity, and OGDC analysis of the 2025 Charter Survey).2

The 2024 coverage period extends through June 2025.

Spotlight on

How Does OGDC Define a Mitigation Action Plan?

Mitigation action plans are company-level documents that set out how individual signatories intend to reduce GHG emissions within their operations towards the defined interim ambition. These plans vary in scope. For example, some focus on a single GHG like methane, while others apply only to a defined perimeter such as operated or upstream assets. Variations may also exist in complexity, length and level of detail. At a minimum, action plans should provide corporate strategy and decarbonization levers and outline the means underpinning these levers, which signatories will apply to meet the established ambitions.

2 Please note the Charter Survey questions pertaining to the action plans changed between reporting years 2024 and 2025: in 2024, responses to these questions were optional, whereas in 2025, they became mandatory. Hence progress is not directly comparable according to verification principles. Please refer to the Appendix for the scope of DNV’s verification statement.

Assessing Overall Emissions

Due to data limitations, last year’s baseline report did not offer total GHG emissions from signatories based on their own reporting. Instead, Rystad Energy data provided an estimate of overall emissions as a starting point.

This year, aggregation of emissions based on companies’ own reporting was identified as a key priority. OGDC leveraged OGCI’s Reporting Framework and definitions to harmonize companies’ submissions and allow like-

for-like aggregation.

As part of the 2025 Charter Survey, DNV verified aggregation of emissions data from 13 to 15 of the signatories depending on the metric. DNV verified the process for data collection without verifying the data. More information can be found in the verification statement available in the Appendix.

DNV’s aggregation of only a subset of OGDC signatories reflects their different starting points, reporting practices and requirements, be they regulatory, shareholder/stakeholder expectations or historical corporate practices.

In addition to DNV’s aggregation, OGDC developed a bottom-up estimate for the first time.

In the following sections, emissions data from signatories were used in graphs, and an estimation of the complete OGDC picture was provided by leveraging Rystad Energy and public data when required. Such data, methodology and graphs were not verified by DNV.

Additional information on OGDC data aggregation methodology and reporting can be found in the “Reference Material” section of the report.

Specific to emissions data, uncertainties and inconsistencies between signatories were identified. OGDC presents the results of the data analysis with the aim of using it as a springboard for further year-on-year improvement.

Production

In 2024, OGDC signatories’ combined operated assets produced nearly 59 million barrels of oil equivalent per day (Mboe/d) in total, accounting for about 35% of global oil and gas production and nearly 40% of global oil production. Around 70% of the OGDC production was operated by NOCs (either directly by the NOC or through formal joint-venture companies between the local NOC and foreign entities), which play a pivotal role in both national and international energy systems.

As we expand our natural gas production – enhancing energy security and affordability across Central Europe – we remain fully aligned with our sustainability goals. Our participation in OGDC reinforces this commitment – supporting GHG emissions reduction and fostering industry-wide collaboration. These efforts are central to achieving a 25% reduction in absolute emissions from oil and gas operations by 2035 and reducing emissions intensity of upstream production, ensuring a credible, balanced energy transition.”

Ireneusz Fąfara, CEO, ORLEN

Figure 6: Total operated oil and gas production (MMboe/day)3

Assessment by OGDC (Source: OGDC analysis of the 2025

Charter Survey and external data from Rystad Energy).

Figure 7: Operated Scope 1 and 2 GHG emissions reported by OGDC signatories (Mt co2e/year)4

Assessment by OGDC (Source: OGDC analysis of the 2025 Charter Survey, external data from Rystad Energy, publicly available data and OGDC estimations).

OGDC signatories span a broad and diverse spectrum of production capacities. Nearly half of the world’s oil and gas companies producing over 1 Mboe/d have joined the initiative, highlighting the scope of the Charter. A majority of signatories are among the 10 largest companies in their respective countries.

Scope 1 and 2 GHG emissions and upstream carbon intensity

Based on the submissions of 41 signatories, covering 92% of OGDC’s oil and gas production, Scope 1 and 2 emissions from OGDC signatories operated assets totaled just above 800 million tonnes in 2024. Leveraging estimations for the remaining 10 signatories with operated assets, OGDC’s total operated Scope 1 and 2 emissions were estimated to be around 1 billion tonnes of CO2e in 2024. Around 45% of these emissions stem from upstream sources.

As seen in Figure 3, 36 signatories have individual third-party assurance statements for their GHG emissions. In 2024, 98% of the Scope 1 and 2 emissions reported by signatories were covered by third-party assurance. Variations in signatories’ internal audit timelines explain why fewer companies are reflected in 2024 compared to 2023, as not all 2024 audits had been completed by June 2025, the final cut-off date for signatories’ data submissions.

The submitted data, combined with Rystad’s estimates for the companies which could not report data, indicated that OGDC signatories’ aggregated upstream carbon intensity for 2024 was approximately 24 kg CO2e per barrel of oil equivalent (boe).5 The 2024 Baselining Survey showed that upstream carbon intensity was 26kg CO2e/boe, based solely on Rystad Energy estimates.6

3 Not verified by DNV.

4 Total OGDC production was estimated using self reported production numbers and third-party estimations (Rystad Energy) where gaps exist. Not verified by DNV.

5 Upstream carbon intensity is calculated using a methodology similar to the OGCI methodology, which defines it as upstream Scope 1 and Scope 2 emissions divided by total production. While OGCI typically excludes LNG and GTL volumes from this calculation, they were included here for the purpose of this indicator. Additionally, upstream Scope 2 emissions were estimated based on historical trends and available data. Therefore, this figure cannot be immediately compared to the much-referenced performance ambition for OGCI of 17 kg CO2e/boe in 2024.

6 Please note the upstream production of OGDC signatories includes joint-venture operating companies where signatories are present and are majority shareholders, e.g., JVs in Libya. Methane emissions are based on satellite detected data, reported figures and Rystad Energy’s proprietary models and databases.

Case study

How ADNOC’s Shah Field Achieved Industry-Leading Carbon Intensity

One of the key challenges facing the transformation of global energy systems is the alignment of large-scale hydrocarbon operations with decarbonization targets, while continuing to meet growing global energy demand. ADNOC aims to maintain its position as one of the lowest carbon-intensive producers in the world, requiring innovative approaches to reduce emissions across its portfolio. The Shah Oil Field presented an opportunity to demonstrate how advanced technologies and clean energy integration can support this effort. Achieving ultra low-carbon intensity at scale demanded a rethinking of operational models, leveraging digitalization, AI and renewable energy to futureproof ADNOC’s business and reinforce its leadership in low-carbon energy.

ADNOC’s Shah Oil Field achieved an industry-leading carbon intensity of 0.1 kg CO2e/boe, a benchmark among global oil fields. This success was driven by a multi-pronged, technology-enabled decarbonization strategy. Central to this was ADNOC’s proprietary AI-powered Centralized Predictive Analytics Diagnostics (CPAD) platform, which uses real-time data to predict equipment failures, reduce unplanned maintenance and enhance asset reliability, resulting in lower energy use and emissions.

Additionally, liquid ejector technology was deployed to recover and reuse gas that would otherwise be flared or vented, enhancing energy efficiency while reducing greenhouse gases. The field also benefited from clean power imports, including nuclear and solar energy, which has been instrumental in supporting efforts to decarbonize energy-intensive field operations.

ADNOC’s experience at the Shah Oil Field offers valuable insights for energy producers aiming to decarbonize:

- Technology is a powerful enabler. Investing in AI, predictive analytics and digital platforms can drive efficiency and reduce emissions.

- Innovation must be paired with operational integration. Technologies like liquid ejectors and clean power imports must be embedded into daily operations to deliver measurable impact.

- Use real-time data to inform decisions and anticipate issues before they escalate. This proactive approach enhances reliability and sustainability.

- Start with a clear decarbonization roadmap and identify quick wins, such as energy recovery systems or clean energy sourcing, that can be scaled. Collaboration across departments and with technology partners is essential.

![3.2 [name of asset], SOCAR, 2024](https://www.ogdc.org/wp-content/uploads/2025/11/3.2-name-of-asset-SOCAR-2024.webp)

Case study

Methane Leadership Program: Turning Commitment into Action for Methane Reduction Across the ASEAN region

In October 2024, PETRONAS, in collaboration with the Association of Southeast Asian Nations (ASEAN) energy operators and international organizations, launched the second edition of the successful ASEAN Energy Sector Methane Leadership Program (MLP). The MLP is an 18-month program, focusing on building capacity and capability to strengthen ASEAN energy companies’ plans, targets, and financing options for reducing methane emissions.

Created in 2023, the MLP includes oil and gas producers and organizations such as the Japan Organization for Metals and Energy Security (JOGMEC) and the Oil and Gas Climate Initiative (OGCI). It has provided companies in the ASEAN region with the knowledge and resources to manage and mitigate methane emissions through workshops and masterclasses covering a wide range of topics including:

- Methane emissions measurement, monitoring, reporting and verification methods and technologies;

- Strategies for methane emissions reduction; and

- Policy and financing discussions.

Under the second edition of the MLP, PETRONAS is collaborating with JOGMEC to establish the Southeast Asia Methane Emissions Technology Evaluation Center (METEC). The first of its kind in Southeast Asia, the center will play a significant role in improving regional methane emissions management efforts by supporting technology trials, expert-led measurement, monitoring, reporting and verification processes, as well as research and development initiatives.

The MLP supports the aims of OGDC to achieve near-zero upstream methane emissions by 2030. It is also aligned with the goals of the United Nations Environment Programme (UNEP) Oil & Gas Methane Partnership 2.0 (OGMP 2.0) and supports the ambitions of the Global Methane Pledge.

Methane Emissions

All signatories aim to reach near-zero methane emissions by 2030.

Based on OGDC analysis of the 2025 Charter Survey and external data estimates from Rystad Energy to supplement non-reported data points, OGDC signatories’ aggregated methane emissions in 2024 were over 4 million tonnes.

Spotlight on

Methane Emissions

As an invisible and odorless gas, methane is, by definition, challenging to detect and quantify. Methane emissions in the oil and gas industry are largely the result of unintended leaks, intermittent venting and incomplete combustion from flaring.

Individual company methane performance varies, reflecting a wide range of maturity on methane management and types of assets within their portfolios. Some signatories have deployed advanced technologies and made significant operational improvements, achieving high-quality data and meaningful emissions reduction over the past decade, as presented in the case studies in this report and on the OGDC website. OGCI members are a clear example of this, having significantly improved their monitoring and quantification practices over the years and having reported a reduction in their upstream methane emissions by over 60% since 2017.

Other signatories are only at the beginning of their journey and remain focused on building internal capacity, developing methane emissions inventories and embedding methane management into their broader decarbonization strategies.

In the past year, two OGDC signatories joined the OGMP 2.0 – a flagship measurement-based reporting and mitigation program of UNEP. To date, 25 OGMP 2.0 members are also OGDC signatories, representing 65% of OGDC oil and gas production.

bp has taken practical steps to support the OGDC Charter— especially on methane. We’ve deployed over 250 methane measurement systems across 42 major oil and gas sites globally, enabling real-time tracking and targeted abatement. Beyond our own operations, we’ve worked alongside OGDC signatories like SOCAR to share learnings from our technology deployments, training and operational insights. This cross-sharing has helped both organizations strengthen their methane strategies and reflects the spirit of collaboration that OGDC is designed to foster.”

Murray Auchincloss, CEO, bp

Methane emissions reported by OGDC signatories that are equivalent to the OGMP 2.0 levels 4 and 5 – integrating source and site level measurements – tripled in the past two years, reflecting growing maturity in emissions quantification and reporting using source level and site level measurement campaigns for reconciliation purposes.

Companies partially or fully reporting their methane emissions at levels 4 and 5 grew from nine to 19 since 2022.

These 19 companies represent 40% of OGDC total oil and gas production, but only 10% of the estimated total methane emissions at OGDC level, reinforcing that robust data facilitates mitigation actions and lower emissions.

According to analysis by OGDC, public disclosure covers 23% of upstream methane emissions submitted by signatories in the survey.

Case study

Technology Sharing and Deployment to Advance Charter Ambitions

ADNOC and TotalEnergies share the strategic priority to reduce methane emissions to near-zero by 2030 and are working within the OGDC initiative to help guide the industry along this path. To accelerate progress, the two companies have recently partnered to pilot the joint deployment of advanced methane detection technologies.

ADNOC has rolled out satellite imaging, drone surveillance, and robotic inspectors with laser-based sensors across its facilities. TotalEnergies has supported these efforts by making one of the industry’s most accurate methane and CO2 detection technologies, AUSEA (Airborne Ultralight Spectrometer for Environmental Applications), available to ADNOC and other partners.

A joint detection campaign using AUSEA has been successfully carried out at the Asab asset operated by ADNOC.

The campaign confirmed very low methane emissions, proving that even large-scale sites can deliver excellent performance. This result demonstrates that near-zero methane emission targets are achievable.

Meanwhile, TotalEnergies has signed cooperation agreements with several national companies, enabling the deployment of AUSEA across all continents, growing the impact of this technology. Maintaining this momentum, TotalEnergies is also enhancing its own operations. By the end of 2025, 13,000 continuous real-time methane detection sensors will be installed across all its operated upstream assets, reinforcing its leadership in emissions monitoring and reduction.

Flaring Emissions

In total, estimated total flared volume from OGDC operated assets was approximately 28 billion cubic meters in 2024, based on submissions from 17 signatories and estimations for an additional 33 signatories. Notably, the absolute reported volume has declined since 2022 for those companies that have self-reported data. This is partly due to OGCI members’ reported reduction of routine flaring by more than 70% since 2017.

Natural gas flaring by OGDC signatories is estimated to account for less than one-fifth of the global flared volumes reported by the World Bank, which highlights Russia, Iran, Iraq and Venezuela as the most prominent countries for flaring and which have limited engagement with OGDC.7

OGDC signatories share the voluntary ambition to eliminate routine flaring by 2030.

Spotlight on

Investing in Energy Systems of the Future

As part of the Charter’s objectives, individual signatories are advancing the energy transition by investing in energy systems of the future, spanning carbon capture, utilization and storage (CCUS), renewables and low-carbon fuels, whilst still investing in hydrocarbon.

According to Rystad Energy, OGDC signatories collectively invested USD 10 billion in renewable energy in 2024, 38% more than in 2023. Among OGDC signatories, solar capacity is primarily concentrated in Asia-Pacific and North America, while Europe leads in wind energy development.

An additional estimated USD $22 billion was invested in other low-carbon solutions such as sustainable aviation fuels (SAF), carbon capture and storage (CCS), and hydrogen (excluding renewables), based on submissions by 25 signatories.8

Signatories are also expanding their involvement in CCS, with strong growth anticipated in the coming years. Rystad Energy projects that OGDC’s carbon storage capacity will increase fivefold by 2030 — rising from 5 million tonnes in 2024 — positioning OGDC signatories to account for 45% of global storage capacity by the end of the decade. Due to limited data availability, comparable figures for investments in CCUS or low-carbon fuels are not included.

7 World Bank, “Global Gas Flaring Tracker Report,“ 2025.

8 Only includes renewable investments where an OGDC signatory is the main developer of the project. Excludes joint ventures and minority stakes led by non-OGDC entities. Full projects spend is counted when a OGDC signatory is the main developer. Same method applies to CCUS.

Conclusion

Implementing action and measuring progress are at the core of OGDC.

The data presented in this chapter demonstrates that in less than two years from the launch of OGDC, progress is underway. More companies are reporting, setting ambitions and developing action plans to support those ambitions.

50 signatories, representing 98% of OGDC operated production, submitted data for this report, including 35 companies which shared performance data with the OGDC Secretariat that has never been published before. These actions reflect the culture shift that OGDC is working to foster.

The foundation for measurable progress is in place, providing a platform on which signatories can build. OGDC signatories remain committed to achieving the aims of the Charter, and the OGDC Secretariat stands as a steadfast partner in supporting their efforts.

Reducing methane is an imperative. Transparency needs to be at the center of industry action, and the OGDC helps companies deliver measurable results and strengthens the accountability and visibility of their efforts.”

Tim Gould, Chief Energy Economist, International Energy Agency (IEA)